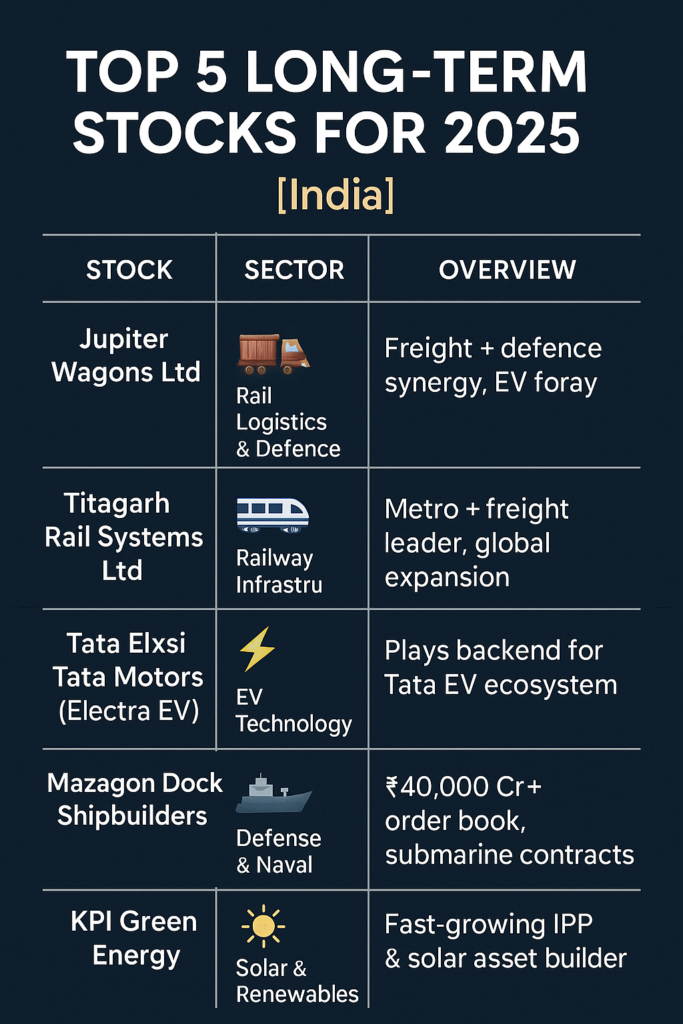

Top 5 Long-Term Stocks to Buy in 2025 [High Growth Sectors]

If you’re planning to build wealth over the next 5–10 years, this is the perfect time to invest in future-ready businesses. We’ve picked 5 high-potential long-term stocks across sectors like EV, defence, infra, and railway logistics — all aligned with India’s economic vision.

Let’s explore the top picks for 2025 and beyond.

1. Jupiter Wagons Ltd (JWL)

- Sector: Rail Logistics, Defence

- Why Buy?

- Strong order book in freight wagons and mobility

- Strategic defence foray + EV plans

- High growth in capex-linked railway reforms

- 5-Year Outlook: Can grow 3–5x with sector tailwinds

2. Titagarh Rail Systems Ltd (TRSL)

- Sector: Railway Infra

- Why Buy?

- Dominates metro and freight segments

- Global expansion in Europe

- Strong government capex support

- 5-Year Outlook: Emerging leader in rail engineering

3. Electra EV (via Tata Group/associated plays)

- Sector: Electric Vehicles

- Why Buy?

- Works behind Tata EV powertrains

- Tech-first, green future aligned

- Government EV policies = major booster

- Play via: Tata Motors or Tata Elxsi

4. Mazagon Dock Shipbuilders (MDL)

- Sector: Defence, Naval

- Why Buy?

- Leader in submarine and warship manufacturing

- Order book worth ₹40,000+ crore

- Strong Make-in-India theme

- 5-Year Outlook: Strong multibagger potential

5. KPI Green Energy

- Sector: Renewable Energy

- Why Buy?

- Strong solar asset development and IPP player

- Growing revenue and ROCE

- Government push toward solar capex

- 5-Year Outlook: Energy transition = growth explosion

🔍 How We Picked These Stocks

- ✅ High RoE + consistent profit growth

- ✅ Government policy tailwinds

- ✅ Future-oriented sectors

- ✅ Strong promoter holding & business scalability

📝 Final Thoughts

India’s next decade belongs to clean energy, rail logistics, and indigenous defence. If you’re building a portfolio for 2025–2030, these stocks give you exposure to that growth.

Invest smart, diversify wisely, and think long-term.

Next Read →