🚆 Jupiter Wagons vs. Titagarh Rail Systems: Which Railway Stock Is Better for a 5-Year Investment?

Overview

As India’s infrastructure development accelerates, railway stocks like Jupiter Wagons Ltd (JWL) and Titagarh Rail Systems Ltd (TRSL) are attracting significant investor interest. Both companies are pivotal in railway manufacturing and modernization, but which one offers a better 5-year investment opportunity (2025–2030)?

This article compares JWL and TRSL on key metrics: financials, growth potential, government orders, and stock performance — providing a clear 5-year investment outlook.

🏢 Company Background

Jupiter Wagons Ltd (JWL)

- Established: 1979 (Jupiter group heritage)

- Focus: Freight wagons, brake systems, railway components, electric mobility (E-LCVs)

- Diversifying into: Defence manufacturing, EV segment (JEM TEZ)

Titagarh Rail Systems Ltd (TRSL)

- Established: 1997

- Focus: Freight wagons, passenger coaches, metro train manufacturing

- Global Presence: Strong export business in Italy and France (Titagarh Firema)

- Make-in-India Leader: Supplied trains to Indian Railways, Kolkata Metro

📊 Financial Performance (FY2024)

| Metric | Jupiter Wagons (JWL) | Titagarh Rail Systems (TRSL) |

|---|---|---|

| Market Cap (₹ Cr) | ₹15,689 | ₹9,417 |

| Revenue (FY24) | ₹3,600+ Cr | ₹3,500+ Cr |

| Net Profit (FY24) | ₹250+ Cr | ₹250+ Cr |

| P/E Ratio (TTM) | 40.84 | 32.91 |

| Debt-to-Equity | 0.21 | 0.03 |

| ROE | 27.59% | 18.15% |

| Dividend Yield | 0.17% | 0.11% |

Sources: ET Money

🔍 Key Growth Drivers

🚆 Railway Capex Boom

- Government’s ₹2.4 lakh crore Railway Budget in 2024 supports both companies.

- Freight corridor development, Vande Bharat coaches, Metro expansions.

🌐 Export Opportunities

- TRSL: Gaining metro coach orders from European countries.

- JWL: Entering EV & Defence sectors (diversification angle).

♻️ Future-Ready Sectors

- EV focus: JWL’s JEM TEZ electric truck.

- Urban transport: TRSL’s metro train manufacturing expertise.

📈 Stock Performance (Last 5 Years)

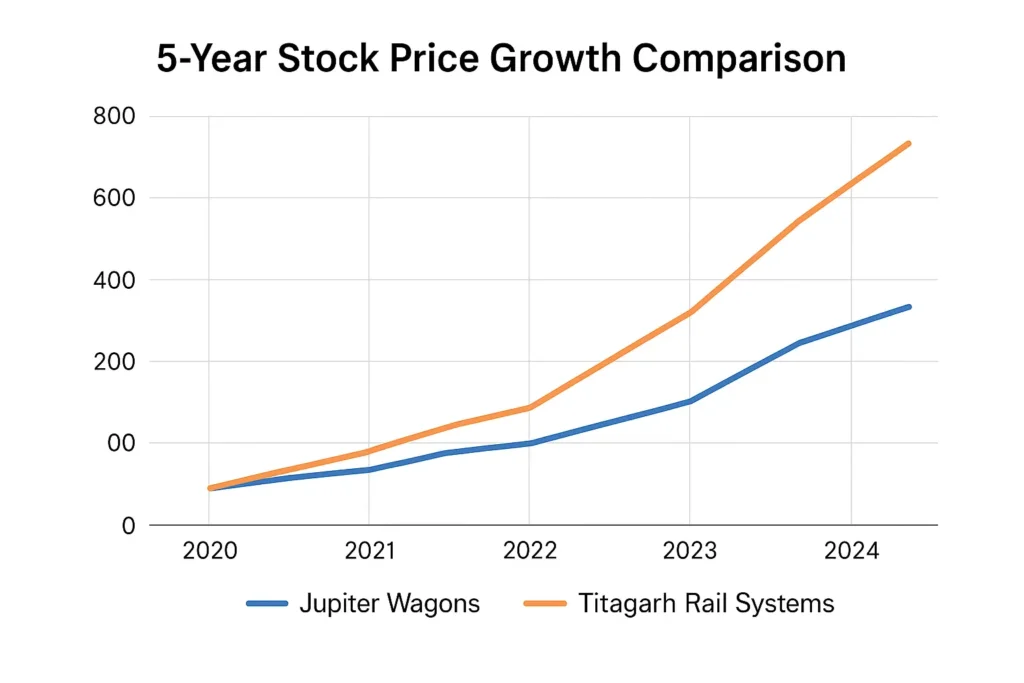

| Stock | Price in 2020 | Price in 2025 | Returns |

|---|---|---|---|

| Jupiter Wagons | ₹20 (adjusted) | ₹369.95 | ~1,750% |

| Titagarh Rail | ₹30 (adjusted) | ₹699.25 | ~2,230% |

💡 Note: Both stocks have shown significant growth over the past five years, with TRSL slightly outperforming JWL.

🧠 Expert Analysis: Which One to Pick?

✅ Choose JWL if:

- You prefer a diversified play (railways + EV + defence).

- You seek an undervalued stock with high potential upside.

- You’re targeting mid-cap growth with lower risk.

✅ Choose TRSL if:

- You’re betting on global metro rail expansion.

- You are comfortable with higher valuations for faster growth.

- You want a stock with proven momentum and execution.

🔮 5-Year Investment Outlook (2025–2030)

| Factor | JWL | TRSL |

|---|---|---|

| CAGR Potential | 18–22% | 20–28% |

| Risk Level | Moderate | Medium-High (due to valuations) |

| Sector Synergy | EV, Defence, Railways | Metro, Passenger, Freight |

| Ideal for | Mid-cap growth investors | Aggressive long-term investors |

📷 Visual Comparisons

Please insert the following images and charts:

- Chart: 5-Year Stock Price Growth Comparison — Line Chart

- Image: Jupiter Wagons Brake System Manufacturing Facility

- Image: Titagarh Metro Train in Italy.

Learn about Algo Softwares in India.

✅ Conclusion

Both Jupiter Wagons and Titagarh Rail are solid long-term bets riding India’s railway revolution. TRSL offers aggressive growth with a global footprint, while JWL provides diversified exposure with an EV & defence twist.

🧭 Smart Portfolio Tip: Consider splitting your ₹3,000/month SIP into 60% JWL and 40% TRSL for a balanced railway portfolio.

📌 Frequently Asked Questions (FAQs)

Q. Is Titagarh Rail a good stock to buy now?

Yes, but it trades at a premium. Ideal for long-term high-growth investors.

Q. What is the future of Jupiter Wagons?

Bright — with expansion into defence and EVs, alongside strong railway orders.

Q. Can I hold both stocks?

Yes. They complement each other well — one offers diversification (JWL), the other high-speed growth (TRSL).